- Engagement: 2017 → Ongoing

- Team: 6 specialists (3 Full-stack Engineers, QA Engineer, Business Analyst, Product Owner)

- Type / Industry: Platform InsurTech / Fintech

- Platform: Web

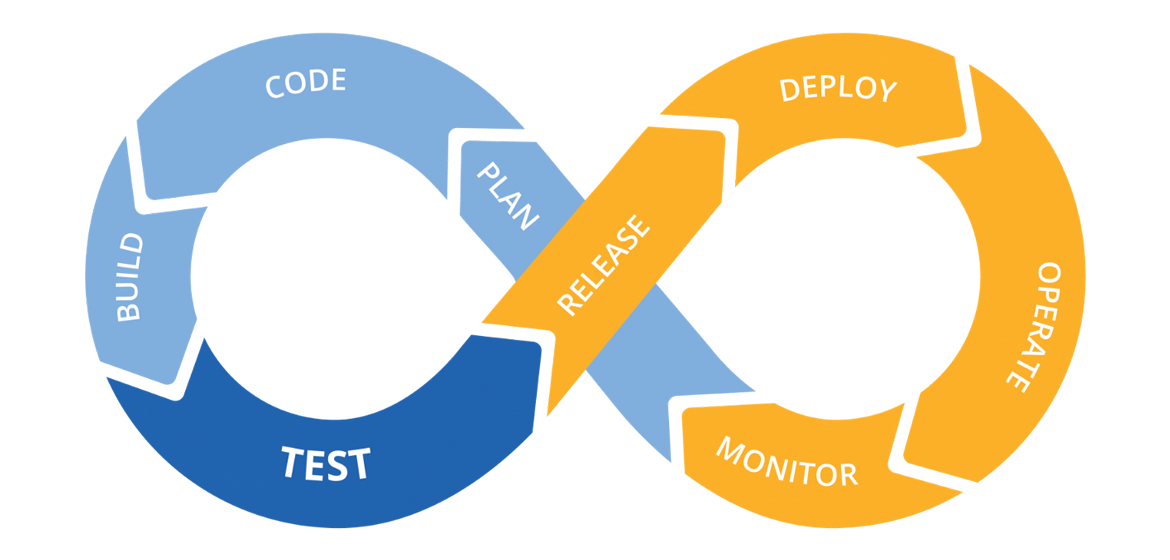

- Tech Stack: Java, Spring, Hibernate, React, ElasticSearch, JavaScript, PostgreSQL, Docker, CI/CD

- Delivered highlights: Unified platform for policy, claim, and payout management, integrations with banking and government systems, scalable modular architecture, automated workflows, continuous QA & DevOps enablement.

UPSK (Ukrainian Fire Insurance Company) is one of Ukraine’s oldest and most reputable insurers, founded in 1992. The company operates nationwide, serving over 30,000 corporate clients and providing 18 classes of insurance covering 25 types of risks.

UPSK is accredited by top Ukrainian banks (Oschadbank, Ukreximbank, Ukrgasbank, OTP Bank) and cooperates with leading global reinsurers such as Gen Re, Hannover Re, Allianz Global Corporate & Specialty, Swiss Re, and SCOR SE.

- Absence of a unified platform for policy and claim management

- Need for scalable IT solutions supporting multiple product lines

- Requirement to integrate securely with banking APIs and government registries

- Manual policy issuance and claims processing increasing operational load

- Shortage of in-house technical specialists for modernization initiatives

- Adapted ProfITsoft’s integrated insurance platform to UPSK’s business model, covering policy issuance, claim settlement, and financial monitoring

- Developed microservice-based modules for claims, contracts, and payouts with rule-based automation and dynamic configuration

- Enhanced the platform UI using React for better usability and process visibility across departments

- Implemented secure API integrations with banking systems and government registries (vehicle, tax, and financial supervision)

- Built synchronization services to automate data exchange and ensure real-time consistency

- Enabled automated reporting, document generation, and audit-ready traceability across business units

- Containerized platform components using Docker for deployment scalability and consistency

- Established CI/CD pipelines for continuous delivery and automated testing

- Implemented ElasticSearch for real-time monitoring, data indexing, and performance optimization

Unified management of policies, claims, and payouts under a single digital platform

30–40% faster claim and contract processing, improving response times and service reliability

Reduced manual data handling and eliminated redundant operations

Accelerated launch of new insurance products through configurable modules

Improved transparency and data integrity across departments

Strengthened UPSK’s market leadership as a tech-driven insurer

- Product Owner

- Business Analyst

- QA Engineer

- 3× Full-stack Developers